The IRS recently updated some rules about trusts that could make your heirs accidentally liable for capital gains taxes. It's another quiet change that could severely impact families trying to maximize their legacies.

What was the last money mistake you made? If you’re like most folks, you’ve made at least one upsetting money mistake in the past year — and you’d like to do better. In fact, most folks admit their finances have not gotten better over the past year. And at least half of them say the real problem is that their money mistakes have turned into bad financial habits.

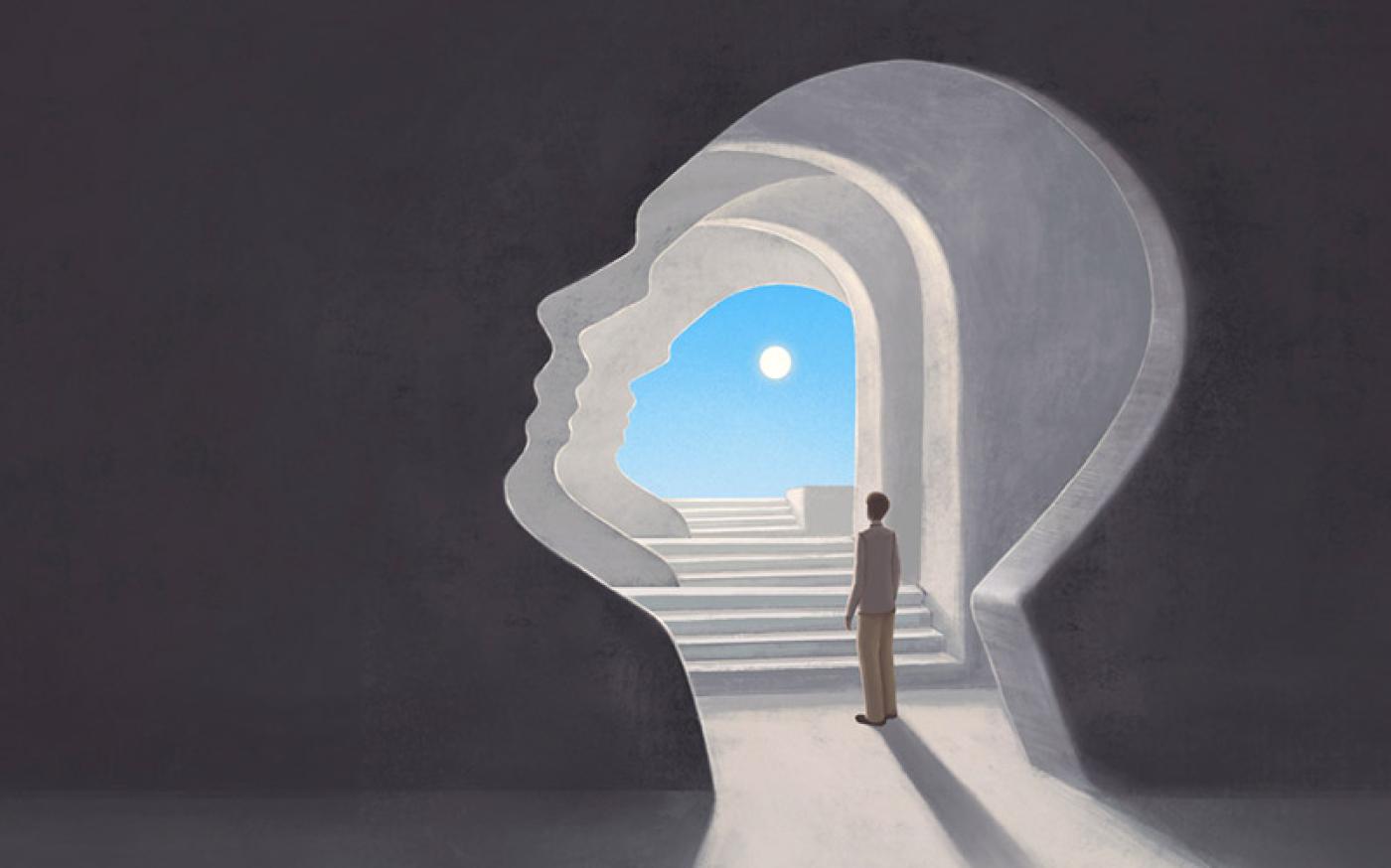

The Dow crosses 45,000. Your brain whispers: "This has to be the top." The market drops 15%. Your brain screams: "Get out before it gets worse!" Different scenarios. Same result...

What’s your ideal retirement? Traveling? Practicing your favorite hobbies? Caring for loved ones? Whatever you envision, creating a plan of action can feel exhausting. There are, however, a few simple, yet commonly overlooked steps you can take today to help you feel more comfortable throughout your planning process.

Over the course of your investing life, you’ll encounter market lows and highs. Headlines often spotlight the extremes, especially when markets reach record levels. Take, for...

How much do you need to retire wealthy? Believe it or not, there’s no set number for anyone. Lifestyle and the quality of your retirement plan are certainly two big factors. But when considering the economy and inflation, a definitive picture of our financial future can feel somewhat elusive. So, to shed a little light (and provide a little guidance), here are a few telltale signs you might be set up for a “comfortable” post-work lifestyle.

With healthcare costs often resembling an unpredictable market, and long-term care expenses looming, the post-work years require careful financial planning. This blog post advocates for partnering with a financial professional to navigate these challenges, offering tailored guidance on Medicare, long-term care funding, and retirement law changes. By preparing strategically, retirees can confidently set sail into their golden years, free from the turbulence of unforeseen financial burdens.

A power of attorney (POA) can grant you certain authority and specific responsibilities. While the extent and limitations of POAs can vary based on many factors, stepping into the role of power of attorney can be unlike anything else. That’s because it puts you in the driver’s seat to make key decisions and oversee vital needs for someone else. That doesn’t mean that POAs come with carte-blanche powers or that one power of attorney will mirror another. Explaining how POAs work, this guide shares more fundamentals, detailing some common types of powers of attorney and the responsibilities you may have as an agent of one of these devices.

As spring arrives and the weather warms up, many people turn their attention to cleaning out closets and organizing their homes. According to a recent survey, about 80% of...

How much do you really know about retirement benefits? If you’re like most Americans, it’s not that much. In fact, most of us have fairly poor “retirement literacy,” especially...

What makes one investor stick with their strategy through market swings while another panics and pulls out? Often, it comes down to mindset. Your investing mindset can shape how...

Tax season might not spark joy, but a refund sure can. In 2025, the IRS estimates the average federal income tax refund will top $3,170. 1 That means a lot of folks are suddenly...